In Lubbock listen weekdays at 5pm on 98.7 FM or 1420 AM, KWBF.

Among the major items of property tax reform passed by Texas lawmakers in the past few legislative sessions has been a set of laws that requires local governments that levy property taxes to follow a uniform system to disclose key information to the public about how annually set new property tax rates, set by those local governments such a cities, counties, hospital districts, etc., affect a citizen’s tax position.

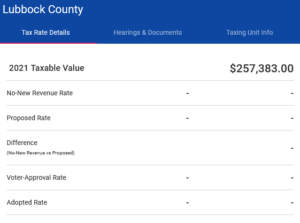

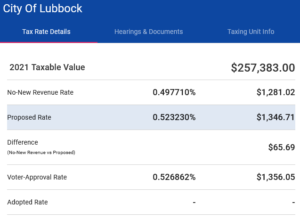

Lubbock County has proposed a large tax increase and yet has failed to disclose to the public the required information which shows a taxpayer how the proposed rate affects their situation. In fact, Lubbock County has even held one of the two required public hearings on the proposed tax increase without disclosing to property owners the detailed information it is obligated to share.

Those who directly pay property taxes in Texas, including those in Lubbock County, have received a post card notifying them of the local website from which they can see “the estimated amount of taxes to be imposed and information on actions taken or proposed actions to be taken by your local taxing units concerning the 2021 property taxes on your property…”

Lubbock County’s website address is LubbockCountyTaxes.org but when taxpayers go to that site, as of the afternoon of Tuesday, 24 August 2021, a day after Lubbock County’s first public hearing on its proposed tax increase, there is no information listed for county taxes.

It would be hard to intelligently address the county’s commissioners’ court at a public hearing without having this information available.

The City of Lubbock has its information listed as do other taxing entities but not Lubbock County, and I checked many addresses to ensure it was not an error linked only to my property.

Oddly enough, the disclaimer at the bottom of the website makes it appear the County itself is responsible for the website despite the postcard coming from the Lubbock Central Appraisal District.

So why is Lubbock County not supplying taxpayers with the information needed to understand how the proposed tax increase will hit their pocketbooks, as required by law?

According to a legislative staff member: “The statutes require that the taxing unit’s designated employee submit the tax rate calculation forms to the appraisal district at the same time they submit the tax rates to the governing body of the taxing unit. The chief appraiser shall make the information available to the public no later than 3 business days after the information and forms are incorporated into the database.”

Lubbock County has even held one of the two required public hearings on the proposed tax increase without disclosing to property owners the detailed information the county is obligated to share.

You can look those statutes up (26.17 and 26.18 of the Tax Code) here: https://statutes.capitol.texas.gov/Docs/TX/htm/TX.26.htm#26.17

That required time frame was long ago. It was when the county judge and commissioners received the information they needed to begin debating and formulating their proposed tax rate for the coming fiscal year. It is likely that those numbers should have been reported on the website in July or early August at the latest.

Sadly local media has reported on the issue completely ignoring the missing Truth in Taxation data even though property owning members of the media received the postcards too and surely noticed that nothing for Lubbock County was posted.

Why is Judge Curtis Parrish withholding key information from taxpayers? Why would he preside over a public hearing on the issue knowing that legally required information has been withheld from county taxpayers?

It is a moral fraud upon taxpayers to have not posted individual property tax numbers on the required website for citizens to see how the big county proposed tax increase affects them directly.

Why is Judge Curtis Parrish withholding key information from taxpayers?

Why would Parrish preside over a public hearing on the issue knowing that legally required information has been withheld from county taxpayers?

Is Parrish, and other commissioners, afraid of how shocked individual voters will be at just how hard the proposed tax increase will hit their budgets as the county claims more for its own?

The reasons don’t really matter, the law does and the law says it is all supposed to be posted on the local Truth in Taxation website.

Thanks Robert for your diligence. It’s just disheartening to know that we’re pinning our hopes of turning the tide on republican politicians, who just seem a little less hell bent on progressive government encroachment as the democrats. Just despicable.

Hi Mr Pratt.

Thank you for sharing this information with us.

I am a much better informed voter and tax payer because of you.

I am appalled that our elected officials would knowingly do this. I am going to get on the phone to our county commissioners and Curtis Parrish and give them an ear full.

I’m going to call Lubbock county appraisal district too.

They have to abide by the laws!!!

Thanks again and God bless you.

Thank you Sharon, don’t let them B.S. you.

There could be many reasons other than fraud that this particular website hasn’t been updated. I saw the various Lubbock County Tax rates enumerated in the press and on the Commissioner’s Court Agenda for 8/23/21. That agenda also provided the formula for calculating your personal tax liabilities. The judge and commissioners have talked about the rates in several meetings, all of which were streaming and can be watched on the county website. What are your reasons for opposing the tax increase? Is it unjustified? Is the county wasting money somewhere? Can you provide specific areas to cut the budget?

Where did I mention opposing the tax increase?

You didn’t read very well. This is about having the required taxpayer specific information on the Truth and Taxation website prior to having the public hearings. Go back and read it, click through to the statutes, and you might see what is obvious about timelines and the moral issue of not having the data available.

They have truly become as slimy as the criminals we have in Washington! I will forward your article to as many people possible.

Thanks Robert! You are truly a beacon in a dark world. Thank you for your work and labor. I’ve “known” Curtis for many a year, he has always been the first to point a finger accusing and bever apologizing when found to be wrong.

Your opposition to the tax increase was inferred from statements made during your shows. I do generally read well and note that these rules applied to the chief appraiser posting information provided by designated officers or employees of the taxing unit. It does not specify the County Judge. But really I object to calling this a moral fraud. Fraud generally requires some intent to defraud someone. Lack of such intent by the County Judge and Commissioners is evident in the many other places they have publicized the proposed tax increase.

The column, as do all, stands on its own. Object all you want, public hearings are held while taxpayers are denied the data they need to see how the proposal will affect them. To not see the moral problem with that says much more about you and those who agree with you than anything else.

Thank you for everything you do Robert! Detailed information is important if you want to attend the hearings; otherwise, you run the risk of asking questions that allow the responders to make you look foolish.