For decades Texans have endured local elected officials who purposely, and sometimes ignorantly, mislead them on local property taxes. I have written much on the subject and the legislature has made changes to try and blunt such dishonesty, but sadly the unscrupulous behavior is not limited to elected officials.

The City of Lubbock’s Chief Financial Officer, D. Blu Kostelich, plays the same games with the taxpayer who employ him as do elected officials when it comes to whether a property tax rate proposed is a tax increase or decrease.

One of my listeners wrote to Kostelich via email: “We the people just cant get more money like you by raising rates, we have to cut our budgets and cost of what we do. You need to start doing the same.”

This is the misleading bull-bleep the citizen received back:

Good afternoon, Mr. **** –

Thank you for contacting the City of Lubbock. We appreciate your comments and feedback. The City’s current tax rate is $0.55802 and the proposed rate before the Council is $0.541573. The City Council will hold a public hearing on September 2, 2020 at 5 p.m. in the City Council Chambers, Citizens Tower, 1314 Avenue K. The City Council welcomes your participation at the public hearing. [Emphasis added.]

The City of Lubbock put out our proposed budget and our tax rate decrease for Citizen’s review in early August on our website at https://ci.lubbock.tx.us/departments/finance/budget-process-and-approval. If you have any further questions or concerns, please feel free to reach out to me directly. [Emphasis added.]

D. Blu Kostelich

Chief Financial Officer | City of Lubbock

1314 Avenue K, Lubbock TX 79401

806.775.2212 (Office)

806.775.3924 (Fax)

bkostelich@mylubbock.us

Kostelich attempts to mislead the citizen with the all too common approach that the proposed “tax rate” is lower yet Kostelich knows that after appraisal changes this new rate still represents a tax increase.

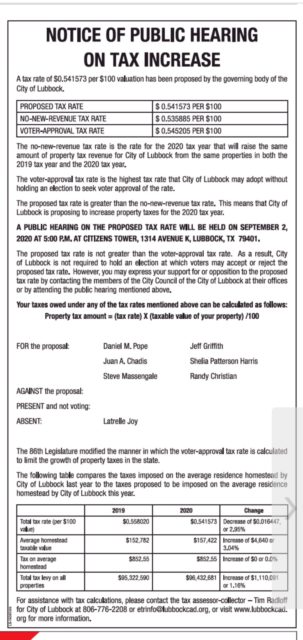

All one has to do is see the city’s SB2 required disclosure (click the image for a larger version:)

There is little question that Kostelich’s reply was designed to obfuscate that fact that the proposed city tax rate is a net tax increase. The reply also attempts, see the sentence I have placed in boldface, to mislead the technically uninformed into thinking that the proposed rate is a tax decrease.

There is little question that Kostelich’s reply was designed to obfuscate that fact that the proposed city tax rate is a net tax increase. The reply also attempts, see the sentence I have placed in boldface, to mislead the technically uninformed into thinking that the proposed rate is a tax decrease.

There is little honor left in our local governments and even less “public service” from highly paid bureaucrats.

Take a look at the City of Wichita Falls where their city manager claimed that to adopt the Effective Rate, or No New Revenue Rate, such would require “cuts” to “police and fire departments.” How does that work given that the No New Revenue Rate brings in the same amount of money from existing taxpayers, via property taxes, as it did in the current year’s budget? And, the city still gets new revenue from new property plus from its other revenue streams like franchise and sales taxes.

Still don’t understand how you are lied to? Try this: “The no-new-revenue rate would mean a $1.4 million decrease in the property tax revenue.” That, my friends is mathematically impossible – it’s not opinion, it is impossible.

We cannot maintain a republic when little by little citizens lose faith in its institutions.

This is terrible in so many ways! The citizens of Lubbock are having difficulty in all areas of their life. The Covid-19 virus has caused financial hardships for so many. This is Not Right to be Raising Taxes, it’s very deceitful to alter figures that are not true! I’m a senior citizens living on a fixed income and it’s difficult to budget every month. We Do Not Want Our Taxes Increased!!!

Tax payer for “No New Revenue Tax Rate