On the subject of how nasty local government officials in Scurry County have been over protecting their massive property tax and county spending increase from being rolled back by voters, is a letter reported to have been sent by Luann Grice who was, at the time of sending, the welfare director for Scurry County.

On the subject of how nasty local government officials in Scurry County have been over protecting their massive property tax and county spending increase from being rolled back by voters, is a letter reported to have been sent by Luann Grice who was, at the time of sending, the welfare director for Scurry County.

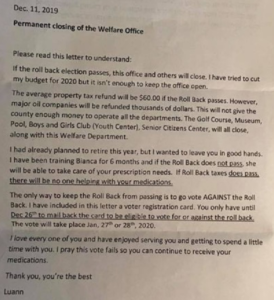

In the letter of 11 December 2019, Grice writes “if the Roll Back does not pass, she [the new director taking over as welfare director] will be able to take care of your prescription needs. If the Roll Back taxes [sic] does pass, there will be no one helping you with your medications.”

In the letter, written as a county employee, Grice tells welfare office clients “to go vote AGAINST the Roll Back” and reminds that they need to register to vote before 26 December in order to do so.

Luann Grice began the letter with “If the roll back election passes, this office and others will close.”

What is particular interesting about this claim which originates from the Scurry County Commissioners Court, is that if voters pass the rollback, the rollback tax rate actually leaves Scurry County with more money to spend in 2020 that it had in the 2019 budget.

Yes officials claim the opposite but Scurry County is not losing income if the rollback election passes. If passed, the county will not receive as much of an increase in property tax revenue as it wanted but the rollback rate still allows the county to grow its Maintenance and Operation (M&O) expenses by a giant eight percent.*

*Under the old law, which covers the 2020 budget year but is replaced with the new property tax reform law (SB 2) for the 2021 budget cycle,a county can adopt a property tax increase of up to 8% before voters have a right to petition for a rollback election. As I understand it from a top tax and budgeting source working for state government in Austin, the rollback rate simply prevents Scurry County from topping the 8% tax increase cap, but it can still adopt a new tax rate and budget that provides an 8% increase in revenue for M&O expenses without voters being able to stop such an increase. Scurry County’s rollback rate calculation is different from most counties because Scurry County adopted an additional sales tax for property tax relief in 1988. Therefore, Scurry County must lower its property tax rate as sales tax revenues increase to provide the required property tax relief to taxpayers. However, Scurry County’s rollback rate calculation still allows it to increase revenue for M&O expenses (i.e., M&O property tax revenue + sales tax revenue) by 8% before voters can petition for an election. See Tex. Tax Code Ann. § 26.041(b) (providing the calculation that a county with an additional sales tax for property tax relief uses to calculate the rollback rate).

Here is the scare-advert run in the Snyder newspaper Saturday by the pro-tax increase group:

The SCCC and County employees have been a bigger than life disappointment to me. Why are they lying to the tax payer? Because they don’t want to be wrong? Everybody makes mistakes. But the mistakes can be remedied.

That’s ridiculous what scurry county government has done! They should be ashamed and so should louann Grice!

So in essence the commissioners threatened job elimination to these employees because they spent the money in the budget!

All these offices closed in spite of rollback not passing. Very selfish county officials.